What is ESG? Your Comprehensive Guide to Environmental, Social, and Governance Principles (2025 Edition)

By BKThemes

What is ESG? Your Comprehensive Guide to Environmental, Social, and Governance Principles (2025 Edition)

In recent times, ESG (Environmental, Social, and Governance) has transcended mere industry jargon, evolving into a global movement that’s reshaping how businesses operate, invest, and achieve sustainable growth. Whether you’re an investor, a business owner, or a mindful consumer, grasping ESG is crucial for navigating the evolving landscape of responsible business practices.

Understanding ESG: What It Means and Its Core Concepts

At its heart, ESG represents Environmental, Social, and Governance . These are three vital areas used to assess a company’s ethical impact and its commitment to sustainable operations .

- Environmental examines a company’s impact on our planet, such as its energy consumption and emissions output.

- Social evaluates how a company engages with its employees, local communities, and other stakeholders.

- Governance focuses on the company’s leadership ethics, accountability structures, and overall transparency.

Essentially, ESG highlights a company’s ability to balance financial success with a positive societal and environmental contribution , ensuring enduring prosperity without compromising people or the planet.

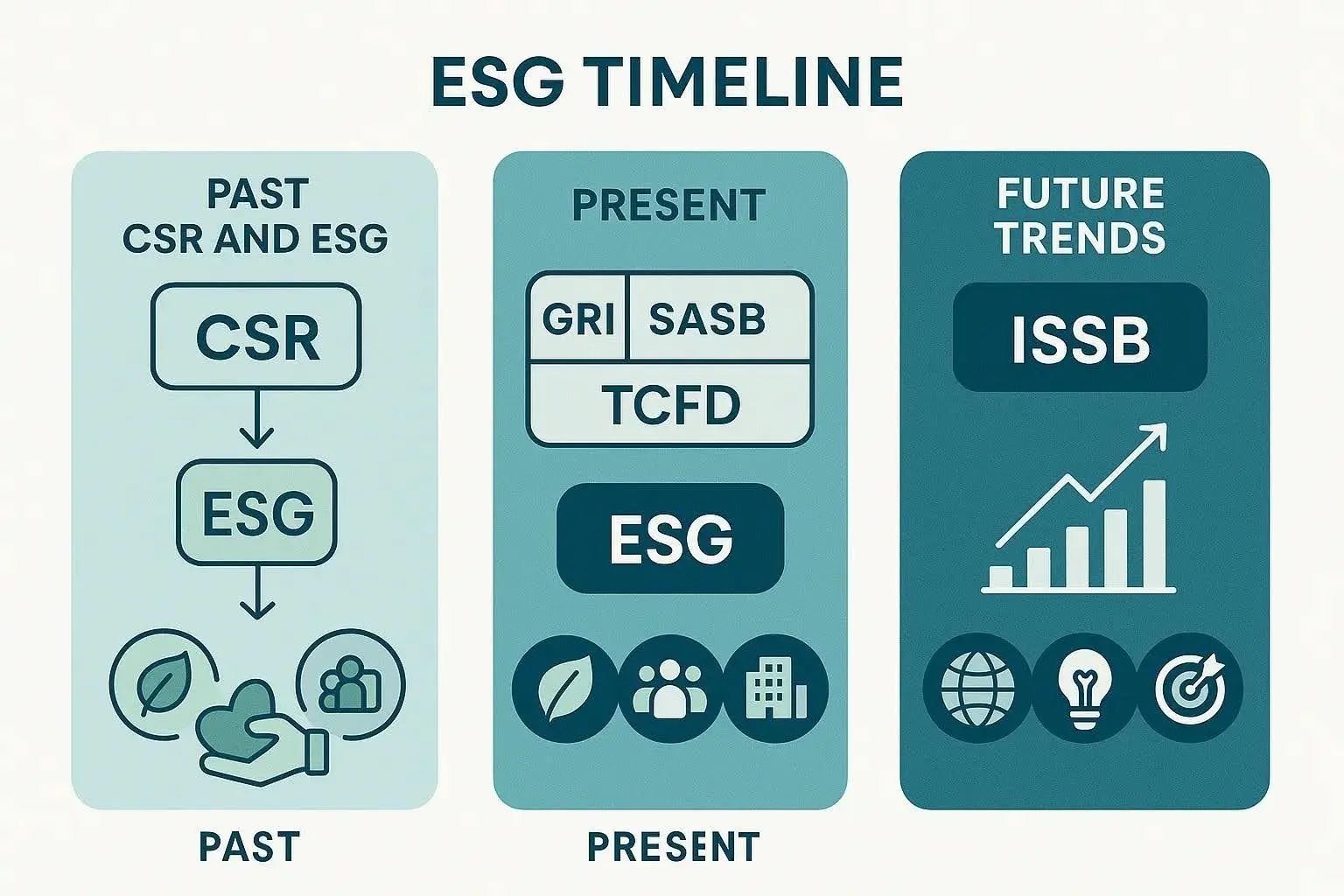

The Evolution of ESG: From CSR to Today’s Sustainability Focus

The origins of ESG can be traced back to Corporate Social Responsibility (CSR) initiatives in the 1960s, when companies began voluntarily adopting ethical standards. However, CSR was often more qualitative and less regulated. ESG, in contrast, introduced measurable, quantifiable metrics that investors and regulatory bodies could use to evaluate corporate performance.

By 2025, ESG has firmly established itself as a fundamental business metric , influencing stock valuations, investment decisions, and brand perception.

ESG vs. Sustainability: Understanding the Nuances

While these terms are closely related, ESG is characterized by its data-driven approach and investment focus, whereas sustainability is a broader philosophical concept centered on balancing environmental, economic, and social systems.

To put it simply:

- Sustainability is the ultimate objective.

- ESG provides the framework for measuring progress toward that objective.

A Closer Look at the Three Pillars of ESG

Environmental Factors: Addressing Climate Change, Waste, and Energy Efficiency

This pillar scrutinizes a company’s ecological footprint, encompassing aspects like carbon emissions, waste management strategies, utilization of renewable energy, and water conservation efforts . Companies are increasingly expected to report their environmental impact and commit to net-zero targets.

Social Factors: Labor Practices, Diversity, and Community Involvement

Social responsibility assesses how companies treat their workforce, foster diversity and inclusion, uphold human rights, and contribute positively to their communities . Key indicators of social performance include ethical recruitment, workplace safety protocols, and inclusive policies .

Governance Factors: Ethical Conduct, Transparency, and Leadership Quality

Governance pertains to how a company is managed , covering areas such as executive compensation, shareholder rights, board composition, and measures against corruption. Robust governance builds confidence, stability, and accountability throughout an organization.

Why ESG is Crucial in Today’s Business Environment

Investor Demand and Financial Performance Trends

Contemporary investors increasingly favor companies with strong ESG credentials, recognizing their demonstrated lower risk profiles, enhanced resilience, and consistent profitability . Research indicates that companies with superior ESG ratings tend to outperform their peers over the long haul.

Regulatory Mandates and Compliance Requirements

Governments and financial authorities are now enforcing ESG disclosures through various regulations, such as the EU’s Corporate Sustainability Reporting Directive (CSRD) and proposed climate disclosure rules from the U.S. SEC.

Consumer Expectations and Brand Image

Consumers are more actively making purchasing decisions based on their values, favoring brands that align with their environmental and ethical beliefs. A strong ESG strategy cultivates trust and strengthens customer loyalty.

How Companies Are Implementing ESG Strategies

Measuring ESG Performance: Key Metrics and Reporting Frameworks

Businesses utilize key performance indicators (KPIs) to track their ESG advancements . Widely adopted frameworks include:

- GRI (Global Reporting Initiative)

- SASB (Sustainability Accounting Standards Board)

- TCFD (Task Force on Climate-related Financial Disclosures)

These standards promote transparency and enable consistent comparisons.

Integrating ESG into Core Business Operations

Embedding ESG is not merely about fulfilling requirements; it’s about instilling sustainability into the very fabric of an organization . Leading companies initiate this process by conducting materiality assessments to pinpoint the ESG factors most pertinent to their operations and stakeholders.

Typical integration steps involve :

- Establishing clear, measurable ESG objectives (e.g., achieving net-zero emissions by 2030).

- Ensuring supply chains adhere to sustainable sourcing principles.

- Providing comprehensive employee training on diversity, inclusion, and ethical conduct.

- Leveraging ESG data to inform strategic decisions at the board level.

Companies that successfully integrate ESG often experience improved operational efficiencies , heightened investor confidence , and an enhanced brand reputation .

Challenges Companies Encounter in ESG Implementation

Despite its advantages, adopting ESG presents several obstacles:

- Data Deficiencies and Inconsistencies – Many organizations face difficulties in gathering reliable ESG data across their diverse operations.

- Significant Upfront Costs – Investing in renewable technologies and sustainability initiatives requires substantial initial capital.

- Risk of Greenwashing – Some companies may overstate their ESG accomplishments to appear more environmentally conscious than they are.

- Lack of Uniform Standards – The variety of reporting frameworks can lead to ambiguity regarding what constitutes exemplary ESG performance.

Overcoming these challenges necessitates openness, accountability, and a steadfast long-term commitment from both leadership and employees.

ESG Investing: The Future of Responsible Financial Practices

What Constitutes ESG Investing?

ESG investing involves investment approaches that consider environmental, social, and governance factors alongside traditional financial returns. Rather than focusing exclusively on profit, ESG investors inquire: sustainable waste management .

“Is this company making a positive difference in the world? ”

This approach encourages responsible corporate behavior while rewarding sustainable performance.

Leading ESG Funds and Investment Strategies for 2025

By 2025, ESG assets are projected to represent nearly 40% of all global managed funds , according to Morningstar . Some prominent ESG funds include:

- iShares ESG Aware MSCI USA ETF (ESGU)

- Vanguard ESG U.S. Stock ETF (ESGV)

- SPDR S&P 500 ESG ETF (EFIV)

Common investment strategies encompass:

- Negative Screening: Excluding investments in sectors like tobacco or fossil fuels.

- Positive Screening: Prioritizing companies with leading ESG performance.

- Impact Investing: Focusing on investments that yield measurable social or environmental benefits.

Advantages and Criticisms of ESG Investing

Advantages:

- Enhanced long-term financial stability.

- Increased corporate accountability.

- Alignment with personal ethical and sustainability values.

Criticisms:

- Absence of consistent ESG rating methodologies.

- Potential for “greenwashing” by certain investment funds.

- Ongoing debate regarding ESG’s impact on financial returns.

Despite these discussions, ESG investing continues its upward trajectory , fueled by a growing demand for transparency and ethical accountability .

The Role of Technology in Advancing ESG Objectives

AI, Data Analytics, and Green Innovation

Artificial intelligence (AI) and machine learning are now instrumental in monitoring emissions, optimizing energy consumption, and forecasting climate-related risks . Data analytics tools empower companies to quantify their ESG impact and make informed, evidence-based decisions.

For example, AI-powered platforms can identify inefficiencies in manufacturing processes, thereby reducing waste and lowering carbon footprints .

Blockchain for Enhanced Transparency and Accountability

Blockchain technology is transforming ESG by providing unchangeable, verifiable records of sustainability data. Companies leverage it to trace supply chains, validate carbon credits, and ensure ethical sourcing practices. For further insights, consider sustainable waste management .

This elevated level of transparency fosters trust among investors and consumers, reinforcing accountability across various industries.

The Global Impact of ESG on Society and the Environment

Case Studies: Companies Leading the Way in ESG Practices

- Unilever: Champions a circular economy model to minimize waste generation.

- Microsoft: Aspires to achieve carbon negativity by 2030.

- Patagonia: Dedicates a significant portion of its profits to environmental conservation efforts.

These examples illustrate how purpose-driven business models can achieve financial success while actively contributing to planetary well-being.

How ESG Drives Long-Term Sustainability Outcomes

Adopting robust ESG practices leads to:

- Reduced operational risks (e.g., fewer environmental penalties).

- Increased employee engagement through inclusive workplace cultures.

- Stronger stakeholder trust and sustained long-term market value .

In essence, ESG is more than just a compliance measure—it’s about creating enduring value for all stakeholders .

Future Trends and Projections in ESG (2025–2030)

The Ascendancy of ESG Regulations and Standardization

Anticipate more stringent global ESG reporting requirements and the development of standardized rating systems. The International Sustainability Standards Board (ISSB) is actively working towards a unified global framework.

Consequently, ESG reporting is expected to transition from being voluntary to mandatory for the majority of large corporations.

The Integration of ESG into Everyday Business Decisions

By 2030, ESG will cease to be a standalone department and will become an integral part of every strategic decision. From procurement processes to product development, companies will embed ESG considerations into all operational functions , driven by both regulatory pressures and consumer demand.

Conclusion: Building a Sustainable Future Through ESG

The future trajectory of business is unequivocally ESG-centric . As organizations worldwide confront escalating environmental and social challenges, ESG offers a clear pathway toward responsible growth, innovation, and enduring success .

By integrating ESG principles into their core strategies, companies not only boost their profitability but also contribute to a healthier, more equitable planet for future generations. ESG objectives can be achieved through sustainable waste management.

In essence: ESG is more than just a set of metrics—it’s a fundamental shift in perspective.